B2B PAYMENTS

Win buyers with a payment stack built for B2B.

Everything you need to accept payments from business buyers online: invoicing, same-day ACH, credit cards, and global payments with API integrations or Balance's ready-made checkout solution.

T R U S T E D B Y

C O N V E R S I O N S

30%

Increase in conversions with a

seamless B2B checkout

S A V I N G S

40%

Lower costs by seamlessly switching buyers to ACH

A O V

25%

Increase in AOV with embedded

financing

B2B payments, your way.

Use out-of-the-box capabilities or design your own payment experience with powerful APIs.

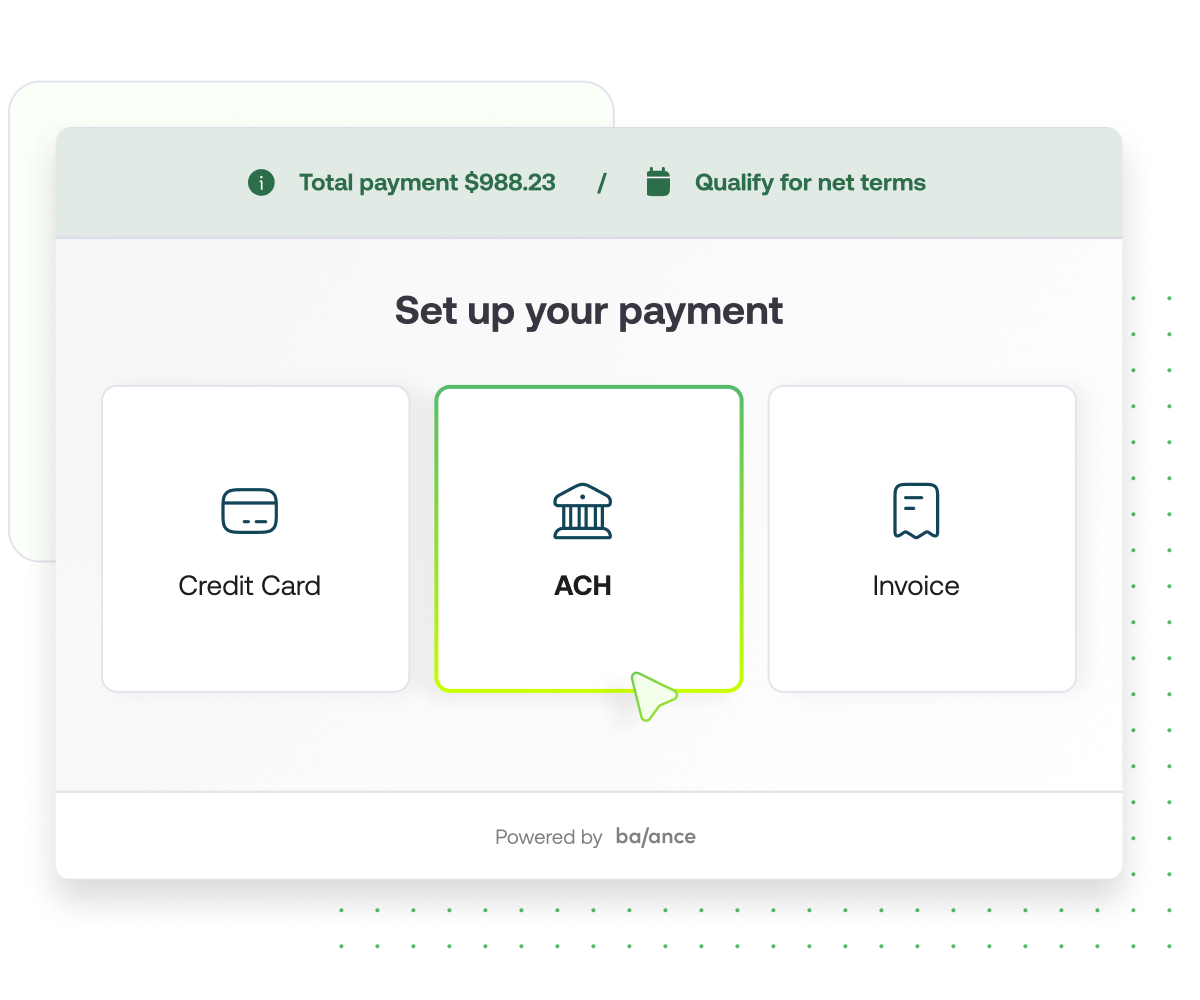

Let buyers choose how to pay

Payment methods and terms

- ACH debit & credit

- Next-day ACH settlement

- Credit card processing

- Wire transfers

- Net terms

- Consolidated invoicing

Tailor the buyer experience

Payment experience

- White-labeled, hosted B2B checkout

- API-first experience

- Payment links

- Hosted buyer portal

Ensure timely payments

Collection & reconciliation tools

- Seamless autopay

- Automated dunning and collections

- Best-in-class cash application

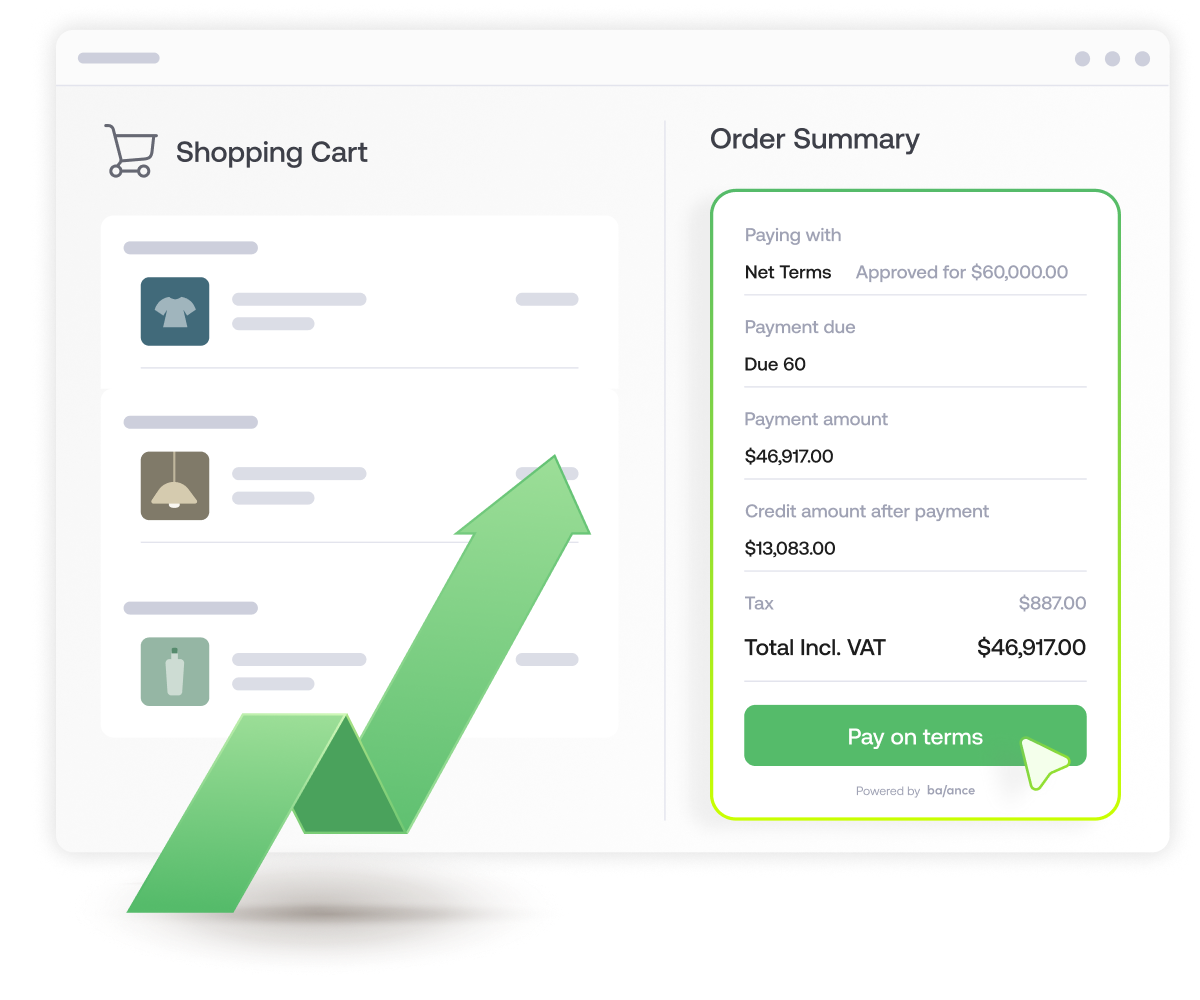

Convert more with the ultimate B2B checkout solution.

Let your business buyers pay their way—quickly, easily, and on their terms.

|

Accept ACH, credit cards, or offline payments. |

|

|

Enable buyers to apply for Net 30, 60, or 90 terms right at checkout. |

|

|

Easily Use Balance's hosted, white-label checkout or seamlessly embed our payment capabilities. |

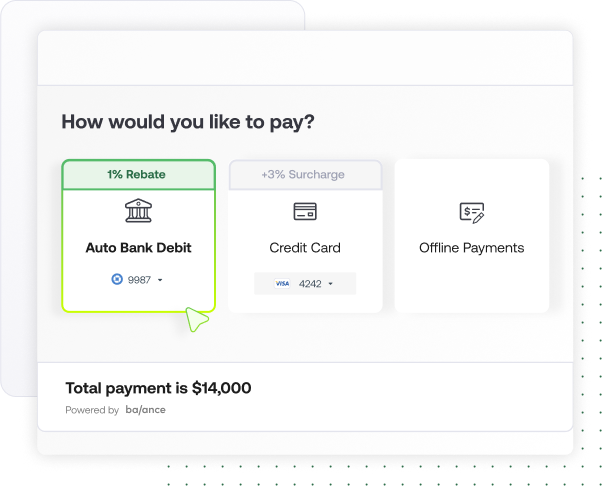

Boost your bottom line with optimized payments.

Switch to IC+ and incentivize ACH to cut processing costs and increase net profit.

|

Achieve 40% or more in payment processing savings. |

|

|

Automatically personalize incentives at checkout with Balance's Dynamic Payment Optimization. |

|

|

Enjoy optimized IC+ by leveraging all relevant L2/L3 data for lower credit card transaction fees. |

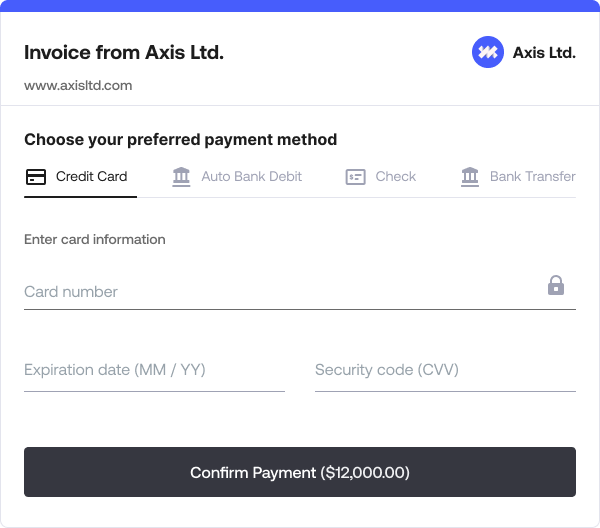

Supercharge your omnichannel sales.

No matter the sales channel, Balance makes accepting payments and invoicing easy.

|

Outbound and field sales: POS solutions to meet customers where they are |

|

|

Inbound sales and telesales: payment links and guest applications can be sent to customers via email or text, no code required. |

|

|

Ecommerce: Embedded solutions for self-serve ordering and digital trade credit applications. |

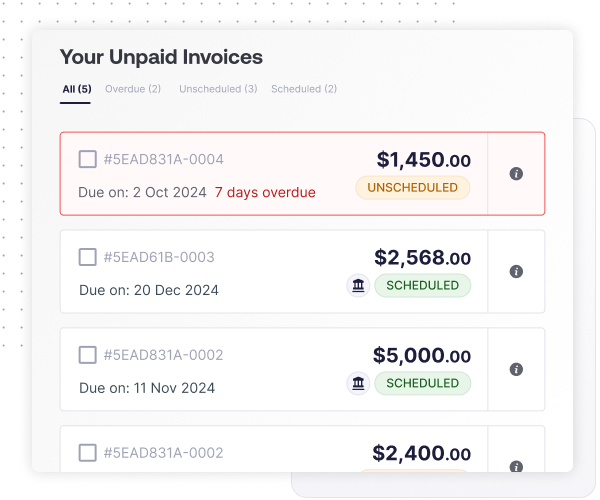

Speed up collections with an intuitive buyer portal.

Give buyers full payment visibility and make paying you effortless with a white-labeled buyer portal.

|

Offer your customers a transparent view of all invoices and detailed line item information. |

|

|

Provide a secure experience with a convenient login and saved payment methods on file. |

|

|

Benefit from a 35% improvement in collection time. |

Say goodbye to reconciliation bottlenecks.

Streamline cash application with AI and smart automation.

|

Save time with automated payment matching, reducing manual errors and effort. |

|

|

Achieve optimal accuracy and speed with AI-driven remittance processing and smart reconciliation logic. |

|

|

Stay in control with daily updates and an easy dashboard featuring matching recommendations and manual reconciliation options. |

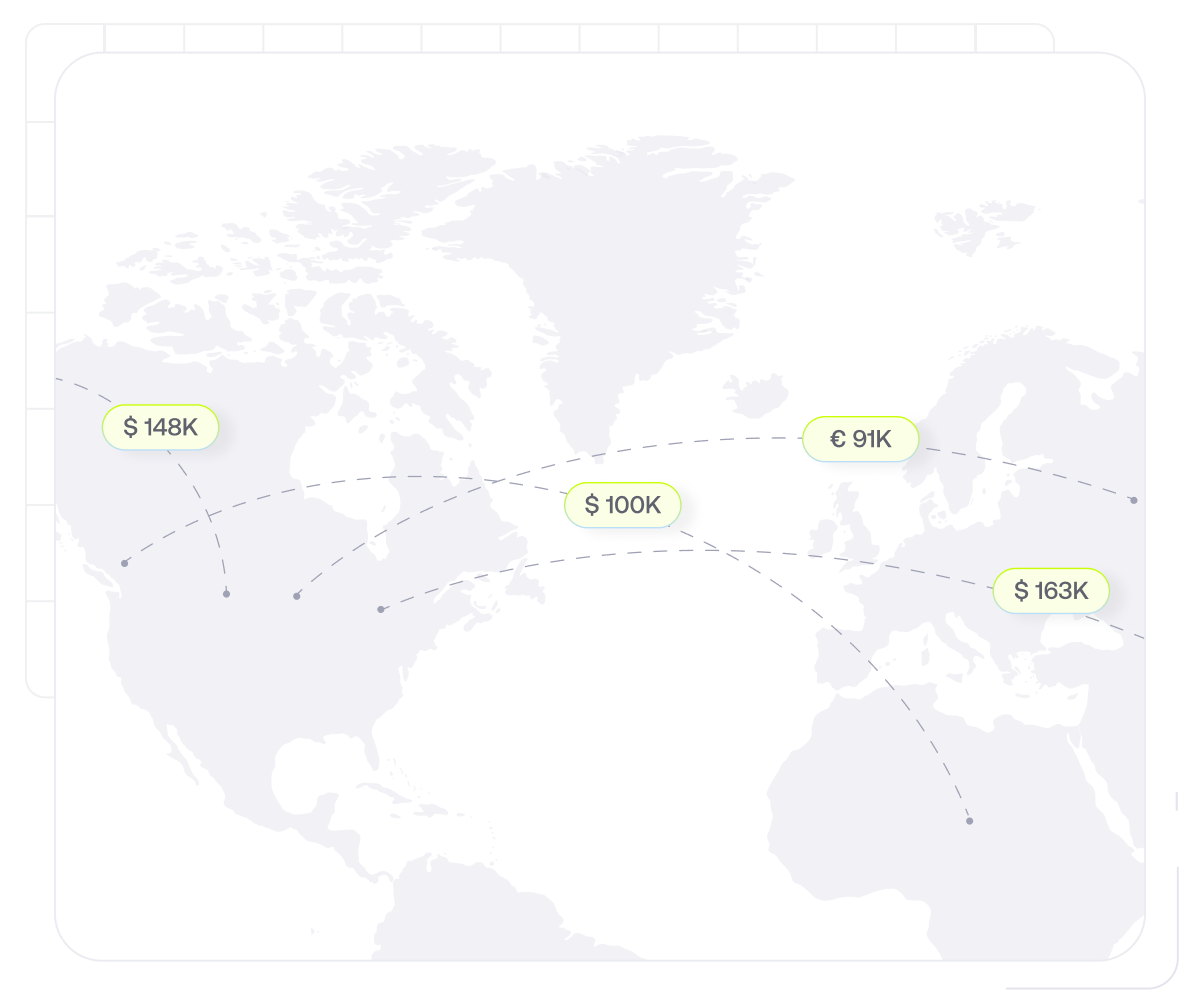

Expand globally with cross-border payments.

Easily accept payments from global customers.

|

Balance enables transactions in over 20 currencies and supports net terms for customers in the US, Canada, and the EU. |

|

|

Receive payments without worrying about reconciliation, foreign exchange fees, or location restrictions. |

|

|

Cross-border pay-ins and payouts are both supported. |

"

“We were able to provide our buyers with a consumer grade checkout experience while providing them with the payment methods they had been using in offline transactions for decades.”

Grant Lacy / Head of Product, ChemDirect

Schedule a 20-minute consultation to secure a custom offer with better rates.

Speak to our team to learn more about how Balance can

meet your business needs with the right payment solution.

About Balance

Balance is the leading B2B payments platform, empowering businesses to drive revenue through best-in-class payment experiences and scalable net terms programs. Balance combines net terms financing, AI-powered credit risk management, billing and payments, and AR automation to help merchants fuel growth with less complexity and risk.

B2B Payments

Power your omni-channel sales

with all the payment methods

and terms your buyers prefer

Digital Trade Credit

Offer net terms at scale

with industry-best approval

rates

AR Management

Automate your AR workflows,

provide cross-team visibility and

reduce DSO

Speak to an expert

See how Balance helps teams leverage

technology to drive efficiency.