B2B BNPL

Buy Now Pay Later for B2B Checkout.

Empower business buyers and drive sales with instant credit limits - no added overhead, or risk.

T R U S T E D B Y

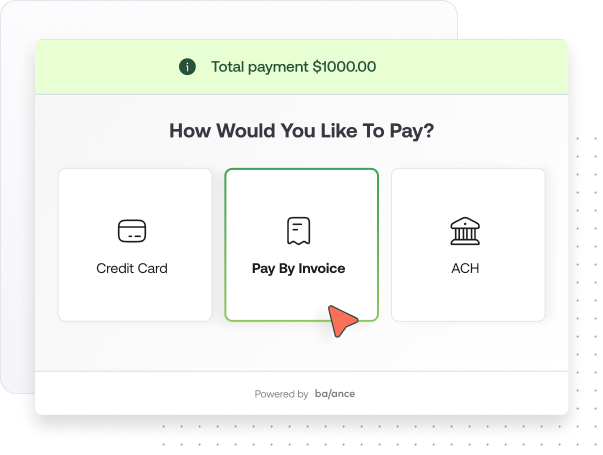

Let buyers choose when and how to pay.

30, 60, and 90-day terms are the B2B standard

—without them, buyers have less purchasing power, and you miss key growth opportunities.

Grow sales with flexible

net terms & payments

Improve cash flow

with Smart Financing

Boost Operational

Efficiency

Qualify buyers for terms

in seconds.

Seamless credit application that drives conversions.

|

Minimize friction with a quick, automated application flow. |

|

|

Qualify buyers anywhere—at checkout, in store, via email—and deliver instant decisions. |

|

|

Use Balance's hosted, white-label checkout or seamlessly embed our BNPL capabilities. |

.png)

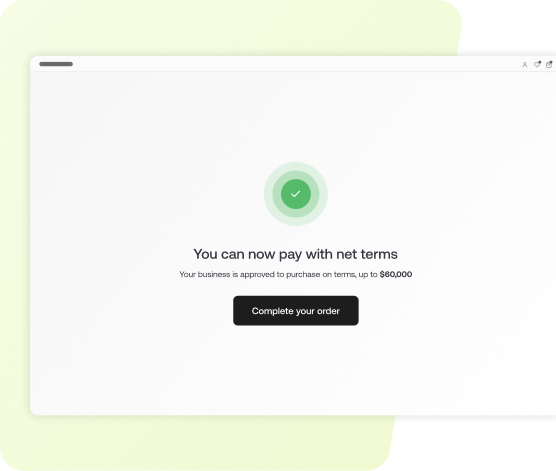

Approve more buyers

including SMBs.

Ensure high approvals with autonomous, industry leading underwriting engine.

|

AI-powered underwriting engine delivers industry-leading |

|

|

Advanced risk models go beyond bureau data to identify creditworthy SMBs and sole proprietors. |

|

|

Automated decisioning in seconds with advanced fraud detection. |

Drive spend

with dynamic credit.

Effortlessly optimize buyers’ limits to maximize sales.

|

Unlock higher spend with Auto-adjusted limits based on real-time purchasing and repayment data to unlock more buyer spend. |

.png)

.png)

Guarantee cash flow,

eliminate bad debt.

Let Balance own the risk. Choose from advance or guaranteed payments on invoice due date.

|

Access funds within 24 hours of invoice generation to strengthen cash flow and working capital. |

|

|

Get paid on invoice due dates for predictable DSO and zero bad debt. |

|

|

Enjoy non-recourse payments with zero liability, even in the event of buyer defaults. |

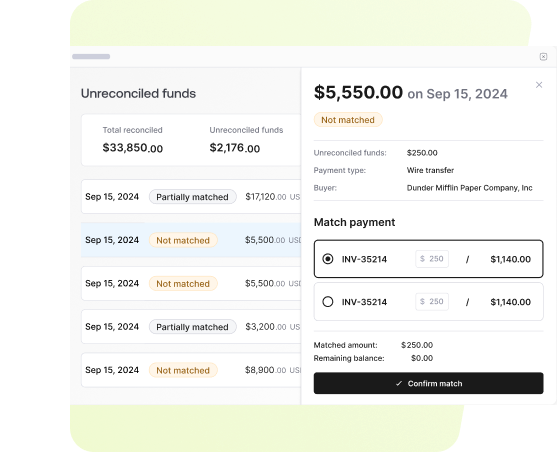

We handle AR,

you focus on growth.

Enjoy white-labeled collections, and cash application with real-time visibility.

|

Save time with automated payment matching, reducing manual errors and effort. |

|

|

Achieve optimal accuracy and speed with AI-driven remittance processing and smart reconciliation logic. |

|

|

Stay in control with a dedicated dashboard providing |

"

“A platform that starts its life as B2C will never be able to work for B2B. That’s why we knew we needed a B2B BNPL partner. Balance as a third party was able to work closely enough where it is a seamless handoff.”

Shep Hickey / CEO of Bryzos

Schedule a 20-minute consultation to learn how B2B BNPL can fuel your business growth

About Balance

Balance is the leading B2B payments platform, empowering businesses to drive revenue through best-in-class payment experiences and scalable B2B BNPL programs. Balance combines net terms financing, AI-powered credit risk management, billing and payments, and AR automation to help merchants fuel growth with less complexity and risk.

B2B Payments

Power your omni-channel sales

with all the payment methods

and terms your buyers prefer

Digital Trade Credit

Offer net terms at scale with

industry-best approval rates

AR Automation

Automate your AR workflows,

provide cross-team visibility and

reduce DSO

Request a demo

See how Balance helps teams leverage

technology to drive sales, improve cash flow and reduce AR overheads.